CBDCs vs Cryptocurrencies | The Future of Digital Money

🌐 Introduction

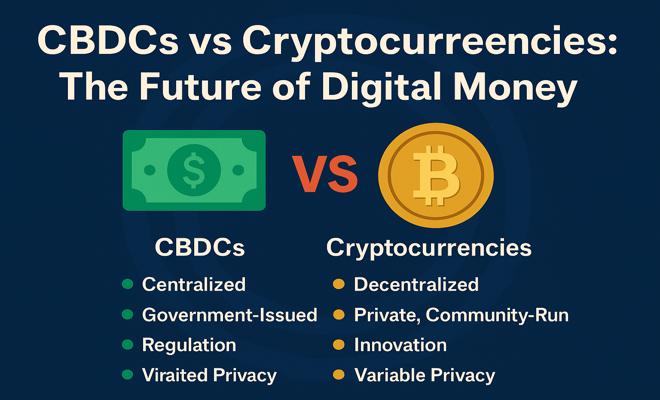

The digital age is revolutionizing the way we think about money. Two game-changing innovations are at the center of this transformation: Central Bank Digital Currencies (CBDCs) 💵 and decentralized cryptocurrencies such as Bitcoin 🪙 and Ethereum ⚙️. Although they both exist in digital form, they serve vastly different purposes and are built on contrasting principles. In this article, we explore the differences, similarities, risks, and future outlook for CBDCs and cryptocurrencies in the global economy 🌍.

🏦 What Are CBDCs?

CBDCs are government-backed digital currencies issued by central banks. They are designed to serve as the digital equivalent of traditional fiat money and aim to offer the same legitimacy and stability—just in a digital form.

- 📲 Digital representation of a national fiat currency

- 🔐 Controlled and regulated by central authorities

- 🏛️ Embedded within national legal frameworks

- 🚫 Access is restricted and not permissionless

Several nations are already piloting or exploring CBDCs, including China 🇨🇳 with its digital yuan, the European Union 🇪🇺 with its digital euro, and the United States 🇺🇸, which is researching a potential digital dollar.

🪙 What Are Cryptocurrencies?

Cryptocurrencies like Bitcoin, Ethereum, and Solana run on decentralized blockchain networks. These digital assets are not issued or controlled by any central authority, and they offer a new model of trust and ownership.

- 🌍 Borderless and censorship-resistant

- 🧠 Governed by code and community consensus

- 🔑 Accessible to anyone with internet access

- 📈 Used in DeFi, NFTs, and as a hedge or investment

At their core, cryptocurrencies represent financial freedom and innovation in a decentralized world.

⚖️ CBDCs vs. Cryptocurrencies: Core Differences

Although both are digital currencies, their underlying ideologies and mechanics differ fundamentally:

| Feature | CBDCs 💵 | Cryptocurrencies 🪙 |

|---|---|---|

| Issuer | Central Banks | Decentralized Networks |

| Control | Centralized | Distributed |

| Legal Status | Official Legal Tender | Varies by Country |

| Privacy | Limited, Transparent to Governments | Variable (Often Pseudonymous) |

| Purpose | Improve payment systems | Promote financial independence & innovation |

🔍 Why Are Governments Embracing CBDCs?

Governments see CBDCs as a tool to modernize outdated financial systems and address challenges posed by cryptocurrencies. Major motivations include:

- 💳 Speeding up domestic and cross-border payments

- 🛡️ Enhancing financial monitoring and anti-crime efforts

- 💰 Streamlining the distribution of welfare and stimulus

- 🌐 Offering a state-backed alternative to stablecoins

🛑 The Risks and Concerns of CBDCs

While CBDCs offer convenience and efficiency, they come with potential downsides:

- 👁️🗨️ Threats to user privacy and financial freedom

- 🧱 Overcentralization and potential misuse of power

- 💳 Disintermediation of traditional banks

- 🔐 Risk of government surveillance and censorship

🚀 Benefits of Cryptocurrencies

Cryptocurrencies provide unique advantages that traditional systems can’t easily replicate:

- 🔓 Open access to financial tools without permission

- 📉 Minimal transaction fees and no intermediaries

- 🌍 Financial inclusion in underserved regions

- 📈 Access to DeFi, tokenized assets, and NFTs

⚠️ Risks and Limitations of Crypto

Despite the benefits, crypto isn’t without flaws:

- 🎢 Price volatility can lead to financial losses

- 🐛 Vulnerabilities in smart contracts and protocols

- 🎣 Exposure to scams, fraud, and phishing attacks

- 📉 Loss of funds due to forgotten keys or wallet hacks

🤝 Can CBDCs and Cryptocurrencies Coexist?

Yes, and they likely will. While they stem from different ideologies, CBDCs and cryptocurrencies can serve complementary roles:

- 🏛️ CBDCs for regulated payments, taxation, and public programs

- 🪙 Cryptocurrencies for investment, privacy, and DeFi participation

Hybrid models may emerge, blending state oversight with decentralized infrastructure. This could give rise to more secure and inclusive financial ecosystems.

🔮 What’s Next for Digital Currencies?

As blockchain adoption continues and Web3 becomes mainstream, we can expect:

- 🏛️ Nations launching fully digital economies

- 🔗 Interoperability between CBDCs and crypto wallets

- 📱 Frictionless payments using blockchain tech

- ⚖️ Regulatory clarity for digital assets worldwide

The tug-of-war between centralized and decentralized money will define the future of finance. Education, responsible innovation, and balanced policies will be key to success.

📢 Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before investing or using digital assets.