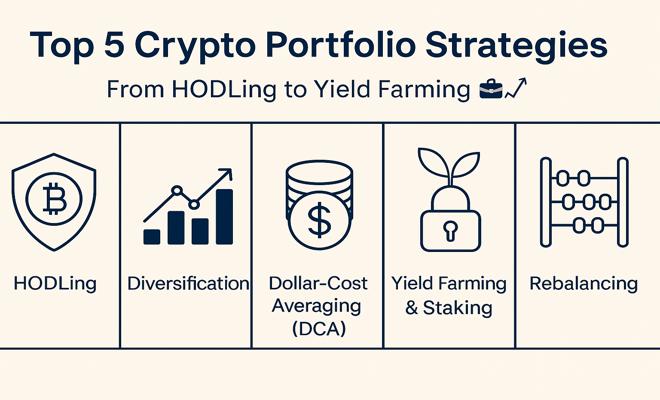

“Top 5 Crypto Portfolio Strategies: From HODLing to Yield Farming 💼📈”

Whether you're new to cryptocurrency or a seasoned investor, creating a smart crypto portfolio is essential to navigate the highly volatile digital asset market. In this detailed guide, we'll walk you through five proven strategies that can help you balance risks, optimize profits, and stay ahead of market fluctuations. 🚀

🔍 What Is a Crypto Portfolio Strategy?

A crypto portfolio strategy is your personal plan for how you allocate, rebalance, and manage your cryptocurrency investments to meet your financial goals. Whether your aim is long-term wealth building or short-term gains, selecting the right approach can make all the difference. Let’s explore the top five strategies popular among investors today.

1. HODLing 🛡️

Definition: “HODL” is a popular crypto term meaning “Hold On for Dear Life.” This strategy involves buying and holding cryptocurrencies over a long period, regardless of market volatility.

- Pros:

- Requires minimal management

- No need for technical trading skills

- Benefits from overall long-term upward trends

- Cons:

- Exposes your investment to full market crashes

- No income generation unless combined with staking

Best for: Bitcoin (BTC), Ethereum (ETH), and well-established blue-chip altcoins.

2. Diversification 📊

Definition: Diversification means spreading your investment across various crypto assets to reduce overall risk.

- Pros:

- Minimizes impact of a poor-performing coin

- Provides exposure to multiple blockchain ecosystems

- Cons:

- More complex to manage and track

- Over-diversification can dilute overall returns

Best for: A mix of large caps (BTC, ETH), mid-caps (SOL, AVAX), and promising small caps.

3. Dollar-Cost Averaging (DCA) 💵

Definition: DCA involves investing a fixed amount regularly, regardless of the asset’s price at each interval.

- Pros:

- Helps smooth out the effects of market volatility

- Ideal for beginners who want to avoid timing the market

- Cons:

- May miss out on gains during strong bull runs

- Requires patience and long-term commitment

Best for: Monthly purchases of Bitcoin or Ethereum.

4. Yield Farming & Staking 🌾🔒

Definition: This strategy locks your crypto assets in decentralized finance (DeFi) protocols or blockchains to earn passive income via rewards or interest.

- Pros:

- Generates a steady passive income

- Can compound returns over time

- Cons:

- Risks associated with smart contracts and protocols

- Possible high fees or penalties when withdrawing

Best for: Ethereum staking on Lido, stablecoin farming on Curve, or liquidity provider (LP) farming on Uniswap.

5. Rebalancing 🧮

Definition: Rebalancing means regularly adjusting your portfolio to maintain your original asset allocation and control risk exposure.

- Pros:

- Encourages disciplined investment habits

- Allows locking in profits and reinvesting in undervalued assets

- Cons:

- May involve transaction fees

- Requires active tracking and decision-making

Best for: Investors who prefer a hands-on approach with monthly or quarterly portfolio reviews.

📈 How to Choose the Right Strategy?

There’s no universal approach in crypto investing. Your ideal portfolio strategy depends on:

- Risk tolerance: How much volatility you can comfortably handle.

- Time horizon: Are you investing for months or years?

- Investment goals: Short-term profits, long-term wealth, passive income, or a mix.

- Portfolio size: The amount of capital you are ready to allocate.

Many investors combine strategies to maximize benefits — for example, HODLing BTC and ETH for the long term, staking stablecoins for passive income, and allocating a small percentage to higher-risk DeFi farming.

🔐 Security First!

Your portfolio’s safety is paramount. Always store your assets in secure wallets. Use hardware wallets for long-term holdings and never invest more than you can afford to lose. Protect your private keys and enable two-factor authentication whenever possible.

🧠 Final Thoughts

Building a profitable crypto portfolio takes time, discipline, and continuous learning. Whether you prefer to HODL, diversify, stake, or rebalance, having a clear strategy tailored to your needs is key to navigating the dynamic crypto market successfully. 💪