CBDCs vs Cryptocurrencies | The Future of Digital Money

🌐 Introduction

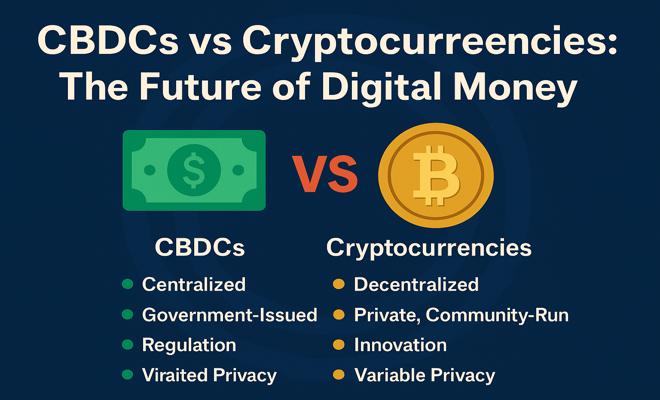

In the rapidly evolving world of finance, two powerful forces are shaping the future of money: Central Bank Digital Currencies (CBDCs) 💵 and decentralized cryptocurrencies like Bitcoin 🪙 and Ethereum ⚙️. While both exist in digital form, their foundations, goals, and implications differ significantly. This article explores the distinctions, overlaps, and future potential of CBDCs and cryptocurrencies in reshaping global economies 🌍.

🏦 What Are CBDCs?

CBDCs are digital versions of national currencies issued and regulated by central banks. They are designed to function as legal tender, backed by the state, and serve as an extension of traditional fiat currency in a digital format. Countries like China 🇨🇳 (with its digital yuan), the European Union 🇪🇺 (digital euro), and the U.S. 🇺🇸 (researching a digital dollar) are exploring or already piloting CBDCs.

- 📲 Digital form of fiat currency

- 🔐 Centralized and controlled by the government

- 🏛️ Subject to regulatory frameworks

- 🚫 Not permissionless — user access is controlled

🪙 What Are Cryptocurrencies?

Cryptocurrencies like Bitcoin, Ethereum, and Solana operate on decentralized blockchain networks. Unlike CBDCs, they are not issued by any government or central authority. Instead, they rely on peer-to-peer consensus, cryptography, and community governance. The main goal is to offer a transparent, censorship-resistant, and borderless form of money 💸.

- 🌍 Borderless and decentralized

- 🧠 Managed by code and community, not governments

- 🔑 Accessible to anyone with an internet connection

- 📈 Often used as assets for investment and DeFi applications

⚖️ CBDCs vs Cryptocurrencies: Key Differences

While both are digital in nature, their core philosophies diverge:

| Feature | CBDCs 💵 | Cryptocurrencies 🪙 |

|---|---|---|

| Issuer | Central Banks | Decentralized Networks |

| Control | Centralized | Distributed |

| Legal Status | Official Legal Tender | Varies by Jurisdiction |

| Privacy | Limited (can be monitored) | Variable (some pseudonymous) |

| Purpose | Efficient payment system | Financial independence & innovation |

🔍 Why Are Governments Interested in CBDCs?

Central banks view CBDCs as a way to modernize monetary systems and combat the risks posed by private cryptocurrencies. Some of the main motivations include:

- 💳 Enhancing payment efficiency and speed

- 🛡️ Increasing financial surveillance to reduce crime

- 💰 Providing direct stimulus or welfare payments

- 🌐 Competing with stablecoins and crypto adoption

🛑 The Risks of CBDCs

Despite their benefits, CBDCs raise serious concerns:

- 👁️🗨️ Privacy Invasion: Government access to individual spending data

- 🧱 Overcentralization: Full control of user accounts by the state

- 💳 Bank Disintermediation: Could undermine commercial banks

- 🔐 Surveillance Risks: Potential for political abuse

🚀 Advantages of Cryptocurrencies

Cryptocurrencies offer a new vision of money based on autonomy and open finance:

- 🔓 Permissionless access to financial services

- 📉 Low-cost, peer-to-peer transactions

- 🌍 Global availability, especially in underserved regions

- 📈 Access to DeFi, NFTs, and emerging financial tools

⚠️ Crypto Risks and Volatility

Still, crypto comes with its own share of risks:

- 🎢 Price volatility affecting value stability

- 🐛 Smart contract vulnerabilities

- 🎣 Scams, rug pulls, and lack of regulation

- 📉 Risk of total loss in case of wallet hacks

🤝 Can CBDCs and Cryptocurrencies Coexist?

Absolutely. While they represent different ideologies, both CBDCs and cryptocurrencies could complement each other. CBDCs may be used for day-to-day transactions and government programs, while cryptocurrencies serve as investment tools, privacy-focused alternatives, or components of decentralized financial systems.

Some central banks may even adopt blockchain-inspired technology for issuing CBDCs, fostering a hybrid model of state-backed decentralization.

🔮 The Future of Digital Money

As we move further into the digital age, the lines between traditional finance and crypto may blur. With the rise of Web3, decentralized identity, and tokenized assets, we could witness:

- 🏛️ Fully digital economies

- 🔗 Interoperable CBDCs and crypto wallets

- 📱 Seamless payments via blockchain

- ⚖️ New legal frameworks for digital assets

The competition between CBDCs and cryptocurrencies will shape the financial future of billions. Education, innovation, and balanced regulation will be key to unlocking their full potential.

📢 Disclaimer: This article is for educational purposes only and should not be considered financial advice. Please do your own research before investing or using any digital asset.

🔗 Visit us at BitMedia24 for more crypto insights.