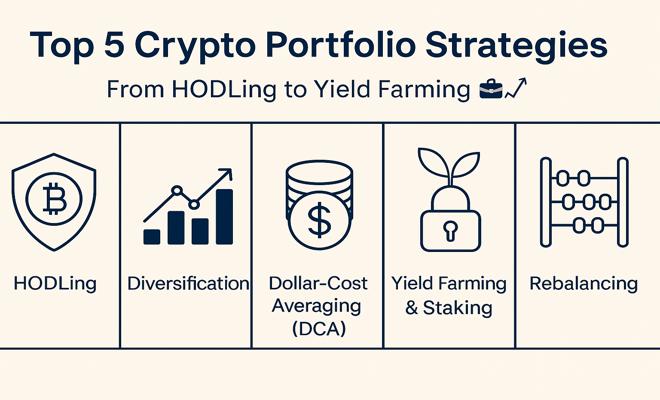

“Top 5 Crypto Portfolio Strategies: From HODLing to Yield Farming 💼📈”

💹 Whether you're a crypto beginner or a seasoned investor, building a smart portfolio is key to navigating the volatile world of digital assets. In this comprehensive guide, we’ll explore five effective crypto portfolio strategies that help balance risks, optimize gains, and stay ahead of market swings. 🚀

🔍 What Is a Crypto Portfolio Strategy?

A portfolio strategy defines how you allocate, rebalance, and manage your cryptocurrency investments to achieve specific goals — whether it’s long-term wealth building or short-term profits. Let’s dive into the top five strategies investors use today.

1. HODLing 🛡️

Definition: HODL stands for “Hold On for Dear Life.” It’s the simplest strategy — buying and holding coins over a long period regardless of market volatility.

✅ Pros:

- Low maintenance

- No need for technical trading knowledge

- Benefits from long-term upward trends

⚠️ Cons:

- Exposes you to full market crashes

- No income while holding (unless combined with staking)

💡 Best for:

Bitcoin (BTC), Ethereum (ETH), and blue-chip altcoins

2. Diversification 📊

Definition: Spreading your investment across various crypto assets to reduce overall risk.

✅ Pros:

- Reduces impact of one coin's poor performance

- Provides exposure to different blockchain ecosystems

⚠️ Cons:

- More difficult to manage and track

- Potential over-diversification can dilute returns

💡 Best for:

Combining large caps (BTC, ETH), mid-caps (SOL, AVAX), and small caps with potential

3. Dollar-Cost Averaging (DCA) 💵

Definition: Investing a fixed amount of money at regular intervals regardless of asset price.

✅ Pros:

- Smooths out price volatility over time

- Great for beginners who want to avoid timing the market

⚠️ Cons:

- May miss opportunities during bullish breakouts

- Requires long-term commitment

💡 Best for:

Monthly Bitcoin or Ethereum purchases

4. Yield Farming & Staking 🌾🔒

Definition: Locking up crypto assets in DeFi protocols or blockchains to earn passive income through rewards or interest.

✅ Pros:

- Generates passive income

- Compounds your long-term gains

⚠️ Cons:

- Smart contract and protocol risk

- Some platforms have high fees or exit penalties

💡 Best for:

ETH staking on Lido, stablecoin farming on Curve, or LP farming on Uniswap

5. Rebalancing 🧮

Definition: Regularly adjusting your portfolio to maintain original asset allocations and control risk.

✅ Pros:

- Maintains portfolio discipline

- Locks in profits from winners and reinvests in undervalued assets

⚠️ Cons:

- May incur transaction fees

- Requires active tracking and decision-making

💡 Best for:

Investors who want a hands-on strategy with regular portfolio review (monthly or quarterly)

📈 How to Choose the Right Strategy?

There’s no one-size-fits-all approach in crypto. Your ideal strategy depends on:

- 🧠 Your risk tolerance

- ⏳ Time horizon

- 💼 Investment goals

- 🧮 Portfolio size

Many investors combine strategies. For example, HODLing BTC + ETH while staking stablecoins and allocating 10% for high-risk DeFi farming.

🔐 Security First!

Always store your assets in secure wallets. Use hardware wallets for long-term holdings and never invest more than you can afford to lose.

🧠 Final Thoughts

Building a profitable crypto portfolio is an ongoing process. Whether you’re HODLing, staking, or diversifying, discipline and strategy are key to long-term success. 💪

Follow BitMedia24 for more crypto guides, tips, and market insights to help you stay ahead in the crypto world! 🌐